The insurance industry is susceptible to money laundering – The insurance industry, often overlooked in discussions of financial crime, presents a fertile ground for money launderers seeking to legitimize illicit gains. This article delves into the vulnerabilities that make the insurance sector susceptible to money laundering, exploring the methods employed by criminals and the far-reaching consequences for the industry.

Despite its critical role in safeguarding financial systems, the insurance industry faces unique challenges in combating money laundering due to inherent vulnerabilities. These vulnerabilities stem from the industry’s reliance on third-party distribution channels, complex products, and large volumes of cash transactions, creating opportunities for criminals to exploit weaknesses in underwriting and claims processes.

Susceptibility of the Insurance Industry to Money Laundering

The insurance industry plays a significant role in the global financial system, offering a wide range of products and services that protect individuals and businesses against various risks. However, this industry also faces a heightened risk of being exploited for money laundering activities due to several inherent vulnerabilities.

One of the key vulnerabilities is the large volume of cash transactions that occur within the insurance sector. Insurance premiums are often paid in cash, and claims may also be settled in cash, particularly in regions with limited access to formal banking systems.

This anonymity and lack of transparency provide opportunities for criminals to launder illicit funds by disguising them as legitimate insurance transactions.

Methods Used for Money Laundering in the Insurance Industry, The insurance industry is susceptible to money laundering

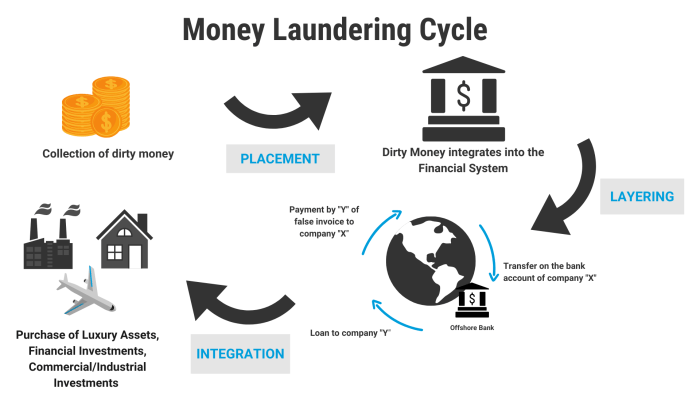

Money laundering in the insurance industry can take various forms, each exploiting specific vulnerabilities. Common methods include:

- Over-Insuring:Criminals may purchase insurance policies with inflated values to launder money. The excess premiums paid can then be claimed as legitimate proceeds.

- Fictitious Claims:Fraudulent claims may be filed to obtain insurance payouts that are then used to launder illicit funds.

- Investment-Based Policies:Criminals may invest in insurance products that offer tax benefits or cash value accumulation. The proceeds from these investments can be used to launder money.

Commonly Asked Questions: The Insurance Industry Is Susceptible To Money Laundering

How does money laundering occur in the insurance industry?

Money laundering in the insurance industry can take various forms, including purchasing high-value policies with illicit funds, filing fraudulent claims, and using insurance policies as collateral for loans.

What are the consequences of money laundering for the insurance industry?

Money laundering can erode trust in the insurance sector, increase premiums for legitimate policyholders, and damage the reputation of insurance companies.

What measures are being taken to prevent money laundering in the insurance industry?

Insurance companies and regulators are implementing anti-money laundering programs, enhancing due diligence procedures, and collaborating with law enforcement agencies to combat money laundering.