Financial management involves all of the following activities except – Financial management encompasses a comprehensive array of activities that are critical for ensuring financial well-being. From meticulous budgeting to prudent investment management, these activities form the cornerstone of sound financial practices.

This article will delve into the various facets of financial management, elucidating their significance and providing practical guidance for effective implementation. By understanding the key components of financial management, individuals and organizations can navigate the complexities of financial decision-making and achieve their long-term financial goals.

Financial Management: Financial Management Involves All Of The Following Activities Except

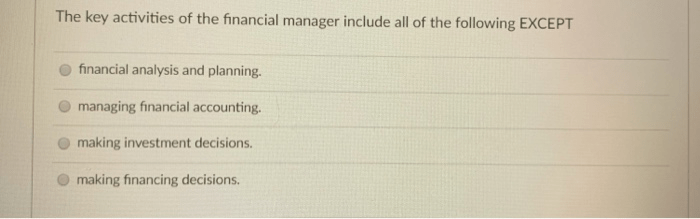

Financial management encompasses the processes of planning, organizing, directing, and controlling financial resources to achieve specific financial goals. It involves a comprehensive range of activities, including:

Budgeting

Budgeting is the process of estimating and allocating financial resources over a specific period. It helps organizations plan their income and expenses, prioritize spending, and control costs. Effective budgeting techniques include zero-based budgeting, incremental budgeting, and activity-based budgeting.

Financial Planning

Financial planning involves developing a comprehensive strategy to achieve long-term financial goals. It includes identifying financial objectives, assessing financial resources, and creating a roadmap for achieving those goals. Financial planning considers factors such as income, expenses, investments, retirement, and estate planning.

Investment Management

Investment management involves making decisions on how to allocate financial resources to achieve specific investment goals. It includes selecting appropriate investments, managing risk, and optimizing returns. Investment strategies vary depending on factors such as investment horizon, risk tolerance, and financial objectives.

Debt Management

Debt management involves managing outstanding debt obligations effectively. It includes strategies for reducing interest costs, minimizing debt-to-income ratio, and improving creditworthiness. Effective debt management ensures financial stability and avoids excessive debt burden.

Cash Flow Management

Cash flow management involves optimizing the flow of cash within an organization. It includes techniques for forecasting cash flow, managing working capital, and minimizing cash shortages. Effective cash flow management ensures liquidity and financial flexibility.

Insurance Planning

Insurance planning involves assessing and mitigating financial risks through insurance policies. It includes selecting appropriate insurance coverage, determining optimal coverage amounts, and managing insurance premiums. Adequate insurance protection safeguards financial resources against unexpected events.

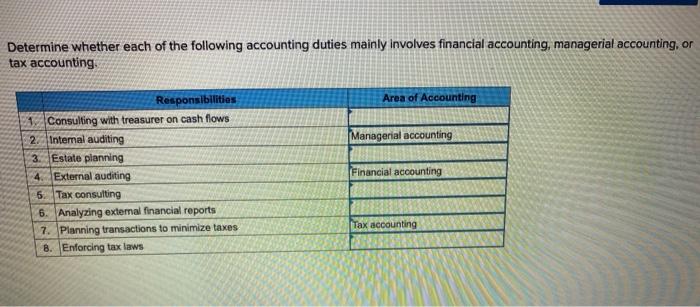

Tax Planning, Financial management involves all of the following activities except

Tax planning involves strategies to minimize tax liability while complying with tax laws. It includes understanding tax deductions, credits, and exemptions. Effective tax planning optimizes financial resources and reduces tax burdens.

Retirement Planning

Retirement planning involves preparing for financial security during retirement. It includes saving for retirement, choosing appropriate investment vehicles, and managing retirement income. Retirement planning ensures financial stability and independence in later years.

Estate Planning

Estate planning involves managing the distribution of assets after death. It includes creating wills, trusts, and other legal documents to ensure that assets are distributed according to the individual’s wishes. Effective estate planning minimizes tax liability and ensures the smooth transfer of wealth.

Answers to Common Questions

What is the primary objective of financial management?

The primary objective of financial management is to optimize the use of financial resources to achieve specific financial goals, such as maximizing profits, minimizing risks, and ensuring financial stability.

What are the key components of a comprehensive financial plan?

A comprehensive financial plan typically includes elements such as budgeting, investment management, debt management, cash flow management, insurance planning, tax planning, retirement planning, and estate planning.

How can individuals benefit from effective financial management?

Effective financial management enables individuals to make informed financial decisions, manage their expenses, save for the future, and achieve their financial goals. It also helps them mitigate financial risks, such as excessive debt or inadequate retirement savings.